Beast from the East, Russia, Facebook, Brexit, Trump, House prices up, House prices down … the Press is full of column inches on Brit’s favourite subjects of politics, scandal, weather and not forgetting (and I appreciate the irony of this!) the property market. As an agent belonging a national group of letting and estate agents, talking to my fellow property professionals from around the UK, the one thing that is immediately apparent is the UK does not have one property market. It is a hodgepodge patchwork (almost like a fly’s eye) of lots of small property markets all performing in different ways.

… And that made me think … is there just one Greenwich Property Market or many?

I like to keep an eye on the property market in Greenwich on a daily basis because it enables me to give the best advice and opinion on what (or not) to buy in Greenwich, be that a buy-to-let property for a Greenwich landlord or an owner occupier house for a home owner. So, I thought, how could I scientifically split the Greenwich housing market into segments, so I could see which part of the market was performing the best and the worst.

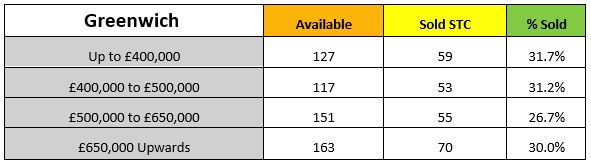

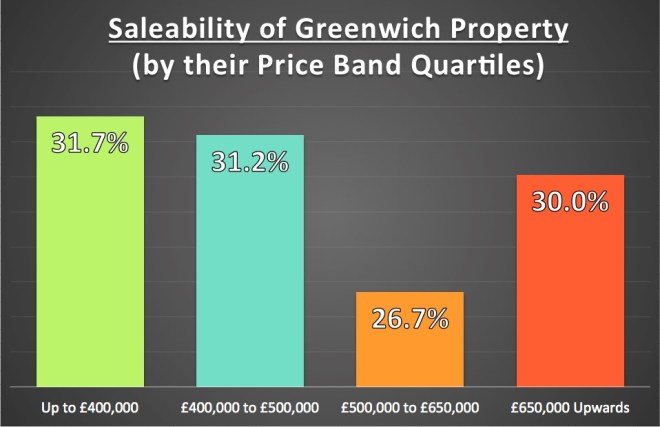

I decided the best way was to split the Greenwich property market into four equal size price bands (into terms of households for sale). Each price band would have around 25% of the property in Greenwich, from the lowest in value (the Lowest Quartile or 25%) all the way through to the highest 25% in terms of value, the Upper Quartile. Looking at the market, I have calculated that these are the price bands in Greenwich are as follows:

- Lowest Quartile (lowest 25% in terms of value) … Up to £400,000

- Lower/Middle Quartile (25% to 50% Quartile in terms of value) … £400,000 to £500,000

- Middle/Upper Quartile (50% to 75% Quartile in terms of value) … £500,000 to £650,000

- Upper Quartile (highest 25% in terms of value) … £650,000 Upwards

So, having split the Greenwich Property Market approximately into four equal sizes, the results in terms what price band has sold (subject to contract or stc) the most is quite enlightening –

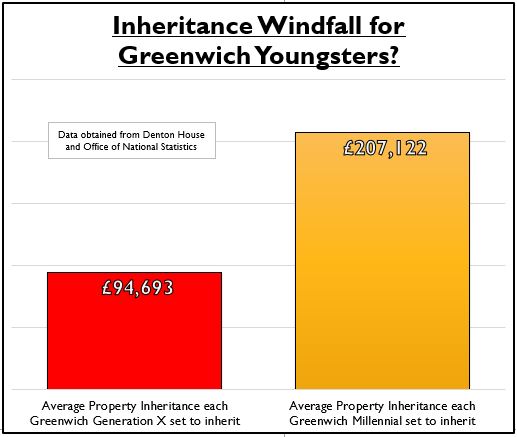

Although the results are very close, the best performing price range in Greenwich is the lower market, although all sectors seem to be finding things a bit tough. Interestingly for Greenwich landlords, with the lower market not selling as well as expected, maybe there could be some bargains out there for buy to let investment? Even though the number of first time buyers did increase in 2017, it was from a low base and the vast majority of 20 something’s cannot buy, so need a roof over their head (hence the need to rent somewhere).

It is a fact that British (and Greenwich’s) housing markets have ridden the storms of Oil crisis in the 1970’s, the 1980’s depression, Black Monday in the 1990’s, and latterly the Credit Crunch together with the various house price crashes of 1973, 1987 and 2008. No matter what happens to us Brexit or anything else … unless the Government starts to build hundreds of thousands extra houses each year, demand will always outstrip supply … so maybe a time for Greenwich landlord investors to bag a bargain?

Want to know where those Greenwich buy to let bargains are? Follow my Greenwich Property Blog or drop me an email because irrespective of which agent you use, myself or any of the other excellent agents in Greenwich, many local landlords ask me my thoughts, opinion and advice on what (and not) to buy locally … and I wouldn’t want you to miss out on those thoughts … would you?